Introduction to Fiat Money

For centuries, economies were like engines starved of fuel. Commodity money—gold, silver, and other tangible forms—was always in short supply, limiting how much could be achieved. Too often, the bulk of available money was spent on consumables, leaving little to invest in the creation of wealth—those lasting, durable assets that drive real progress. Then came fiat money, and with it, a solution to the age-old scarcity. Suddenly, pieces of paper and, more astonishingly, entries in a computer could supply the economy with the fuel it needed, unleashing the possibility of endless growth. But this newfound power is both a gift and a peril. Like fire, money conjured from nothing can build civilizations when controlled—or bring them to ashes when misused. But this is uncharted territory. The real challenge is recognizing that the power of fiat money lies in its very ease of creation—what makes it so useful also makes it dangerous. The balance isn’t just about how much money to create, but about controlling the immense power that comes with it. Whoever controls the money supply holds the reins to both prosperity and potential catastrophe. And the stakes couldn’t be higher.

The invention of fiat money stands as one of the most transformative developments in the history of human economies. It is a leap as revolutionary as double-entry bookkeeping, and yet, unlike that quietly elegant accounting method, fiat money has a reputation that stirs both excitement and suspicion. For good reason: fiat money represents a bold departure from the millennia-old reliance on tangible commodities like gold and silver. Instead, its value is based on nothing more than collective trust in the government and the systems backing it. And yet, despite this intangible foundation, virtually all the money created worldwide today is fiat money.

Fiat money can be understood as currency that has no intrinsic value; its worth is derived solely from the decree of the government—hence the term “fiat,” which comes from the Latin for “let it be done.” Unlike commodity money, which is backed by physical assets like gold or silver, fiat money holds value because a government says it does. The bills in your wallet or the digits in your bank account aren’t redeemable for any specific asset. Instead, they are recognized as legal tender, which means they must be accepted in payment of debts and for goods and services within the issuing country.

It’s an elegant solution to a problem that plagued economies for centuries: the shortage of money itself. When money is tied to finite commodities, the supply is inherently limited. Gold and silver are scarce, and when economies grow faster than the supply of these metals, they face shortages of money, which in turn stifles economic activity. When money is scarce, most of it ends up being spent on consumables—things we need to survive, like food and clothing, or in our modern society, healthcare, education, or legal fees—leaving little left over to invest in creating lasting wealth, such as infrastructure, technology, and durable goods. The result is that commodity-based money systems tend to limit growth.

Fiat money breaks those chains. By decoupling currency from finite resources, governments can allow as much money as the economy requires to grow and thrive. In theory, this opens the door to a world where money is no longer a constraint on production and progress. But there’s a catch—one that keeps both economists and policymakers up at night.

Fiat money’s greatest strength is also its greatest danger: it can be created with relative ease. Without the need for a tangible commodity to back it, money can be issued whenever it’s needed. This flexibility allows governments to respond quickly to economic crises, fund large-scale projects, and ensure that there’s enough money in circulation to keep the wheels of the economy turning. In times of recession, more money can be created to stimulate economic activity.

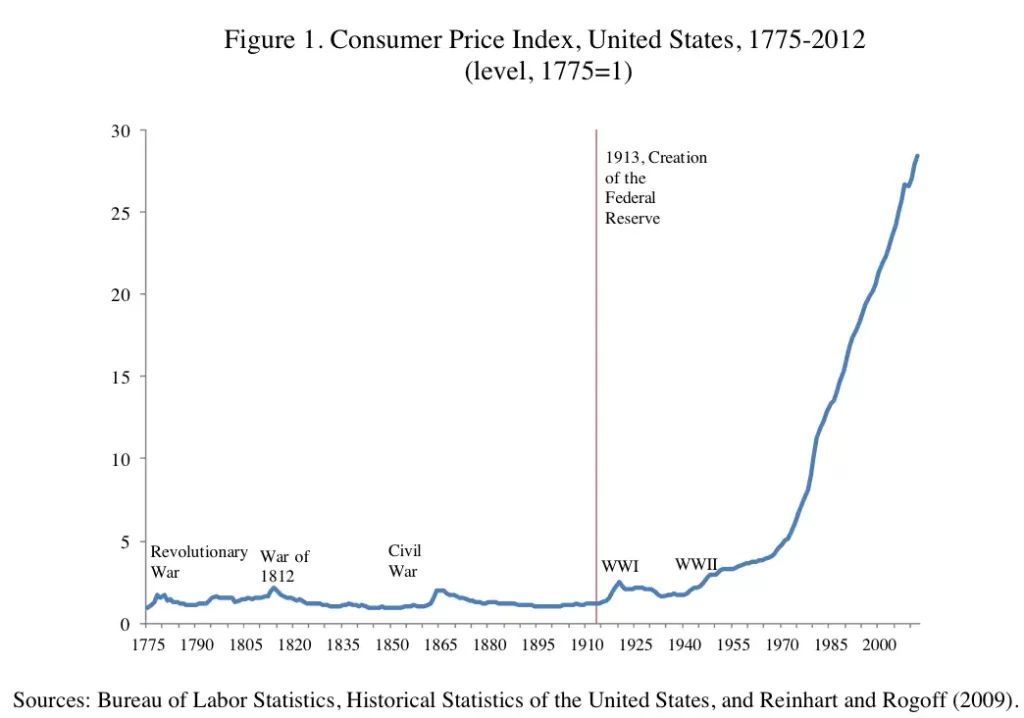

However, with this power comes great responsibility. The oversupply of money can lead to inflation, a condition where the value of money erodes and prices rise across the board. Inflation is the constant shadow that hangs over the creation of fiat money. When too much money chases too few goods, prices spiral out of control, leading to economic instability. Critics of fiat money often point to the wave of global inflation that followed the abolition of the gold standard in the early 1970s as proof of fiat money’s destructive power. Indeed, since that time, typical inflation between the 1970 and 2024 has been about 720% in countries around the world. That averages almost 4% annually.

U.S. inflation from 1776 to 2024. Inflation accelerated after the U.S. abandoned the gold standard.. From the website https://www.officialdata.org/us/inflation/1776?amount=1 Other countries have similar inflation rates.

But is inflation an unavoidable consequence of fiat money? Or does it simply reflect poor management of a powerful tool? In this book, we’ll argue that the advantages of fiat money far outweigh its disadvantages. The problem isn’t fiat money itself, but how it’s managed. Like fire, fiat money can create incredible growth, wealth, and prosperity when handled with care. Left unchecked, it can also cause destruction. The key is not to fear fiat money, but to understand it.

At its heart, fiat money is backed by something intangible but incredibly powerful: trust. Trust in the government that issues it, trust in the institutions that regulate it, and trust in the system that facilitates its exchange. All money requires the trust that accepting money in an exchange will allow a future exchange using that money. Fiat money requires a higher level of trust because there is no underlying commodity that has intrinsic value. Without that trust, fiat money would indeed be worthless—just scraps of paper or meaningless numbers in a computer. But because governments stand behind it, fiat money has become the “currency of the realm” across the globe.

What’s particularly interesting is that, in most cases, the government isn’t the entity creating money on a day-to-day basis. That task largely falls to commercial banks. Through the process of lending, banks effectively create money by generating deposits in the banking system. When you take out a loan to buy a house or start a business, the bank isn’t giving you gold from a vault—they’re creating new money in the form of a deposit in your account. This decentralized creation of money is one of the most fascinating aspects of the modern financial system. While governments control the supply of money indirectly, through interest rates and regulatory policies, the actual creation of money is dispersed throughout the banking system.

To truly grasp the potential of fiat money, we must break free from the old ways of thinking that dominated during the era of the gold standard. Much of our economic theory still treats money as a scarce resource, a relic of times when its supply was tied to physical commodities like gold. This mindset also perpetuates the idea that money must be created through borrowing, restricting its availability to the pace of debt creation. While concerns about inflation and careful control of the money supply remain essential, the real shift we need is to recognize that, with fiat money, scarcity is no longer an inherent constraint. The challenge now is to rethink how we manage this unlimited resource responsibly.

Fiat money offers opportunities that were unimaginable in the age of commodity-backed currency. It provides a level of economic flexibility that can help nations navigate crises, reduce poverty, and invest in long-term growth without being constrained by the scarcity of physical resources. While all real resources—like labor, energy, and raw materials—remain finite, fiat money can be invested to mitigate those limitations. For example, money can be used to fund education and training, addressing shortages of skilled workers like doctors and engineers, or it can support research to develop alternatives to scarce minerals or metals. However, this flexibility demands new economic thinking. Many economic schools still approach money as if it were something inherently scarce, a mindset inherited from the gold standard era, which limits our ability to fully harness fiat money’s potential.

But the global shift to fiat currencies is a revolution, and with it comes the need for new economic schools that understand the inherent power of fiat money. To unleash its full potential, we must learn to manage it wisely, embracing the flexibility it offers while guarding against its dangers.

In the chapters to come, we’ll explore how fiat money functions, how it can be harnessed for the public good, and how new economic models are emerging to take full advantage of this powerful tool. Despite its critics, fiat money holds the key to solving many of the most pressing challenges of the modern world. The question isn’t whether fiat money is dangerous, but whether we’re ready to master it.

Key Features

Fiat money lacks intrinsic value but still meets many of the key characteristics that economists consider essential for money. These traits—portability, divisibility, durability, uniformity, limited supply, and intrinsic value—were first identified when economists studied how commodities like gold or silver became reliable mediums of exchange. Fiat money satisfies most of these traits, except for intrinsic value. The crucial aspect of limited supply is managed through government control. This regulation ensures that fiat money remains useful as currency.

Fiat money meets most of the classic characteristics of money, making it a reliable medium of exchange in modern economies. It is highly portable, whether in physical form or as digital entries that can be transferred instantly across the globe. It is divisible, allowing it to be broken into smaller units for both minor and large transactions. Durability is another key feature—coins and banknotes are designed to last, and digital money is immune to physical deterioration.

Fiat money is also uniform, with every unit of a given denomination being identical in appearance and value. While it lacks intrinsic value, its worth comes from the trust people place in it and the backing of the government. The supply of fiat money, though theoretically unlimited, is controlled by central banks to maintain its value and prevent inflation. These features ensure fiat money functions effectively in its primary roles: as a medium of exchange, a unit of account, and a store of value.

The most notable characteristic of fiat money is that it has no intrinsic value. A dollar bill is just a piece of paper, and electronic money is just a series of numbers on a screen. In commodity-backed systems, such as the gold standard, money held value because it was backed by a physical substance with its own intrinsic worth. Fiat money, by contrast, holds no inherent value; it is valuable because people accept it in exchange for goods and services. This acceptance hinges entirely on trust in the issuing government and the stability of the financial system.

Fiat money is established and maintained by government decree. It is designated as legal tender, meaning that it must be accepted as a form of payment within the issuing country. This characteristic is crucial because it means the value of fiat money is not based on any physical commodity but on the authority of the state. Governments, through their central banks, control the issuance and regulation of fiat money. The value of a nation’s currency, therefore, reflects the economic and political stability of the government backing it. Fiat money is the “currency of the realm,” accepted because the state mandates its use. Cryptocurrencies, like Bitcoin, bear many of the characteristics of bank account money, but it is not considered fiat money because it has no government sanction except in El Salvador.

Unlike commodity money, which is naturally limited by the availability of the underlying resource (e.g., gold or silver), fiat money can be created in unlimited quantities by governments. This theoretical possibility of unlimited supply is both a strength and a potential danger. In practice, central banks regulate the money supply to prevent devaluation and inflation, but the ability to create more money allows for a level of flexibility that commodity-backed systems could never offer. This flexibility has allowed governments to respond to economic crises by expanding the money supply, as seen during the global financial crisis of 2008 and the COVID-19 pandemic.

With great flexibility comes great responsibility. The ease with which fiat money can be created brings with it the risk of inflation. Inflation occurs when the supply of money grows faster than the supply of goods and services in an economy, causing prices to rise and the purchasing power of money to decline. This is one of the most common criticisms of fiat currencies. Throughout history, episodes of excessive money creation have led to devastating hyperinflation, as seen in Weimar Germany and more recently in Zimbabwe. The risk of inflation is an inherent feature of fiat money, requiring careful management by central banks to maintain price stability.

One of the great advantages of fiat money is the control it gives governments and central banks over monetary policy. In a fiat system, central banks can regulate the money supply, set interest rates, and implement policies like quantitative easing to manage economic growth, control inflation, and respond to financial crises. Commodity-backed currencies, by contrast, tie the hands of policymakers. With the money supply limited by the availability of the underlying commodity, it is far more difficult to respond to changes in economic conditions. Fiat money’s flexibility allows for a more dynamic and responsive economic system.

In chapter 10 we will show how eliminating income taxes and substituting a transaction tax can stimulate economic growth and provide a more effective tool for changing the direction of the economy. Chapter 11 goes further an describes modifications to the system that can allow fiat money to be even more effective.

Three Early Examples of Fiat Money

Tally sticks offer an exciting and lesser-known glimpse into the history of fiat money. The government issued them for major purchases. They were typically made from hazel wood or willow wood branches into which notches were carved to represent the value. These types of wood were chosen for their availability and ease of use, as they were strong but could also be easily split into matching halves. The split created two pieces: one, known as the “stock,” was held by the government or creditor, while the “stub” or “foil” was held by the debtor. The matching notches ensured that the debt could only be settled when both pieces were reunited. The use of these woods was practical because they were durable enough to last long periods but soft enough to carve with ease, making them ideal for this purpose

Tally sticks were used in England starting around 1100 CE until their abandonment in 1834. They were primarily a way for the government to record debts. They functioned as a form of credit, representing a claim on future tax revenues. Though issued by the Exchequer, tally sticks circulated much like money, often substituting for coins when actual specie (gold or silver) was scarce. This was especially valuable in times when the Crown needed to finance wars or other major expenditures without immediate access to hard currency.

Interestingly, tally sticks were largely used for large-scale transactions, such as paying taxes or settling debts between the Crown and its creditors. This contrasts with commodity money, like gold or silver, which was more commonly used for smaller, everyday exchanges. This division of usage allowed both systems to coexist. While tally sticks provided a way to defer payments and manage government debt, coins were often preferred in smaller, more immediate transactions.

The interplay between tally sticks and commodity money highlights the flexibility of early monetary systems. Tally sticks were also transferable, and a secondary market for them developed, allowing creditors to exchange them at a discount or use them as collateral. This reflects their role as a precursor to modern fiat currencies, circulating based on trust in the Crown’s ability to meet its obligations, much like today’s money relies on public confidence in government backing.

As a precursor to later paper and digital forms of money, tally sticks were an ingenious solution that laid the groundwork for systems where trust in the issuer, rather than the inherent value of the material, defines money’s worth

Another example occurred in colonial America, where the colonies often issued fiat money to fund military efforts or infrastructure projects. The first colony to issue fiat currency was Massachusetts in 1690. The colony had just financed a military expedition to Canada and found itself in debt without enough hard currency to pay soldiers. To meet this need, the Massachusetts government issued paper notes, which were promises to pay at a future date. Other colonies, recognizing the benefits of having more liquid currency, soon followed suit. Over time, many of the thirteen colonies, including Pennsylvania, New York, and Virginia, issued their own fiat currencies.

These early fiat currencies were often intended to be temporary measures. The colonies would issue paper notes that could be redeemed at a future date in hard currency, such as gold or silver, or used to pay taxes. This helped the colonies manage their debt and finance public projects or military endeavors. Because there was no central authority controlling the money supply, each colony’s currency varied in value and stability. Initially, many of these notes held value well because they were backed by the promise of redemption and tied to the colonies’ tax systems.

However, redemption was not always straightforward. In some cases, there were delays or uncertainty about whether redemption would ever occur, leading to a decline in the public’s confidence in these currencies.

The widespread use of colonial fiat currencies created tensions with English merchants. Since the colonial paper money had no intrinsic value and was not always easily redeemable in gold or silver, English merchants who traded with the colonies were skeptical of its worth. They wanted to be paid in reliable hard currency, and they complained that the depreciation of colonial fiat money hurt their profits. As a result, they lobbied the British government to regulate or restrict the colonies’ issuance of fiat money.

In response to pressure from English merchants, the British Parliament passed several acts aimed at curbing the use of fiat currency in the colonies. The Currency Act of 1751 was the first attempt to control colonial money issuance, specifically targeting New England colonies. It prohibited them from issuing new bills of credit (paper money) and limited the use of existing bills for payment of public debts.

The Currency Act of 1764 expanded these restrictions to all the American colonies. This law forbade the colonies from issuing any new paper currency and required that all debts to British merchants be paid in gold or silver. This was a major blow to colonial economies, which were dependent on their own paper money due to the lack of sufficient hard currency in circulation. Many colonists viewed these restrictions as an infringement on their economic independence, contributing to the growing resentment that eventually fueled the American Revolution.

When Benjamin Franklin was in France during the American Revolution, he famously explained the economic success of the American colonies in part by referencing their creation of paper money. He spoke to French intellectuals about how the colonies, particularly Pennsylvania, had issued paper currency to stimulate their economy. In one notable conversation, Franklin remarked that the colonies were able to thrive by issuing their own money, which circulated within the local economy, enhancing trade and industry.

Franklin saw this as a crucial factor in the prosperity of the colonies, as they often lacked sufficient gold and silver currency. He advocated the idea that paper money could be an effective tool when well-managed, as it allowed for economic expansion despite the absence of hard currency. His views on fiat currency were progressive for the time, and his experience as a printer of Pennsylvania’s paper money gave him firsthand insight into how well it could work.

Franklin believed that the value of money came not from its material but from its utility in facilitating economic activity, which he conveyed to the French with enthusiasm. This perspective was in line with his broader economic philosophy that viewed money as a medium of exchange and a tool for growth, rather than something tied inherently to gold or silver.

Guernsey’s experiment with fiat money is a fascinating and successful case of a small economy using a government-issued currency to overcome a financial crisis. It began in the early 19th century when Guernsey, a British Crown dependency, was in dire financial straits.

By 1816, Guernsey faced deteriorating infrastructure and needed to rebuild, particularly to repair roads and a crumbling sea wall. However, the island lacked the necessary funds to undertake these projects. Guernsey had very little hard currency (gold or silver) in circulation, and the local economy was suffering.

Instead of borrowing from external sources or taxing an already strained population, Guernsey took an innovative approach. In 1820, the States of Guernsey decided to issue its own paper currency—fiat money that was not backed by gold or silver but by the government’s promise to accept it as legal tender for taxes and other payments. This money was used to pay for the needed infrastructure repairs, and it was issued in small denominations to ensure it would be widely accepted.

One of the unique aspects of Guernsey’s experiment was the coexistence of its fiat money with traditional commodity-backed money. Gold and silver still circulated on the island, but the locally issued fiat currency was accepted alongside it, especially in the payment of local taxes and wages for public works. The key to its success was that Guernsey’s fiat money was only issued in proportion to the work done, preventing inflation and ensuring that the economy did not become flooded with too much currency.

Guernsey’s currency proved so successful that it quickly gained acceptance among local merchants, who trusted it because the government controlled its issuance and backed it with the economic improvements it financed. The infrastructure projects, especially the improvements to the sea wall and roads, enhanced the economy and boosted public confidence.

Unlike many historical experiments with fiat money, which often led to inflation and collapse, Guernsey’s system was carefully managed. The States of Guernsey did not over-issue money, and because it was used primarily for productive infrastructure projects, the island saw economic growth without inflation. Guernsey’s paper currency continued to circulate for many years, even as commodity money remained in use.

In the modern world, virtually all money is fiat money, meaning that it is not backed by a physical commodity like gold or silver but instead derives its value from government decree and public trust. The lesson from Guernsey’s experiment is particularly relevant today: a well-managed fiat currency can foster economic stability and growth, if its supply is carefully controlled.

Guernsey’s early experiment is a reminder that the value of money lies not in the material from which it is made but in the trust people place in it and the system that issues it. This principle continues to underpin today’s global monetary system, where fiat money is universally used, relying on central banks and governments to maintain its stability.

Development of Banknotes

Banknotes are essentially promissory notes issued by banks, representing a claim on a specific amount of money or goods, which eventually evolved into currency in its modern form. The first widespread use of paper money began in China during the Tang and Song dynasties, where it served as a practical solution to the logistical challenges of transporting heavy metal coins across vast distances. By the 17th century, European economies, particularly in England, also began experimenting with paper currency through the issuance of promissory notes by goldsmith-bankers, leading to the birth of modern banknotes.

In Europe, early banknotes were originally backed by the promise of redemption in gold or silver, making them representative money. Goldsmiths in England held deposits of gold for merchants, and over time, began issuing notes that could be traded for goods and services, thus functioning like currency. This system gained wider acceptance as central banks like the Bank of England started issuing standardized banknotes in 1694. These notes became widely accepted as currency, provided they were backed by trust in the issuing institution and its reserves of gold.

In the early 18th century, John Law’s experiment in France with the Mississippi Company is an important example of the fluidity of paper money and speculation. He issued shares in the company, which effectively functioned as currency, leading to an economic bubble that eventually burst, but the episode demonstrated the potential and dangers of paper money not backed by sufficient assets.

Following John Law’s failed experiment, France experienced another significant foray into paper currency during the French Revolution with the issuance of Assignats. These were originally introduced in 1789 as bonds backed by confiscated church property, intended to alleviate France’s massive national debt. Over time, Assignats transitioned from bonds into a form of fiat currency, circulating alongside metallic money. However, the uncontrolled printing of Assignats led to rampant inflation as their value quickly plummeted, and public trust in the currency eroded. By 1796, the French government was forced to abandon Assignats altogether, making it a cautionary tale about the dangers of over-issuing paper money without adequate controls or trust mechanisms.

As trust in bank-issued notes grew, especially when backed by central authorities like the Bank of England, banknotes became integral to economic transactions. They facilitated trade, reduced the need to carry heavy metallic currency, and allowed economies to expand more flexibly.

Today, banknotes have evolved into fiat money, meaning they are no longer tied to commodities like gold. Instead, their value is based on government decree and public trust in the issuing institution. Although they have no intrinsic value, they continue to circulate widely because of the collective belief in their value and stability. With the rise of digital payments, physical banknotes are less central to everyday transactions, yet they remain a symbol of a nation’s monetary system and its trustworthiness.

The Early Modern Gold Standard

In the early days of national currencies, many countries operated on bimetallic standards, where both gold and silver were used as the basis for money. This system seemed to offer stability, as it allowed for a greater supply of money, backed by two valuable metals instead of just one. However, it was not without its problems. The most significant issue arose from the fluctuating market values of gold and silver, which often made one metal more valuable than the other. When this happened, people tended to hoard or melt down the more valuable metal and use the less valuable one for transactions. This phenomenon is known as Gresham’s Law, which holds that “bad money drives out good.” As a result, silver would often dominate the circulating currency if gold was more valuable, or vice versa, creating instability in the monetary system.

The problems with bimetallism became more acute during periods of economic upheaval, particularly as global trade expanded, and the supply of silver fluctuated more than gold. In response to these issues, many countries began moving toward a gold standard in the 19th century, where the value of their currency was directly tied to a fixed quantity of gold. This system provided much greater stability for international trade, as it ensured that currencies could be exchanged at predictable rates, based on the fixed value of gold.

The shift toward a gold standard began in England in the early 19th century. Although England had been using both metals, it effectively moved to a gold-based system in 1717 when Sir Isaac Newton set a fixed price for gold, inadvertently favoring it over silver. By 1821, following economic disruptions caused by the Napoleonic Wars, England officially adopted the gold standard, making it the first major economy to do so. This move toward gold was followed by other countries, especially as the industrial revolution expanded trade and global economic integration. Countries like Sweden, Germany, and the United States soon followed, abandoning silver or bimetallic standards in favor of gold. By the late 19th century, most of the world’s major economies had joined the gold standard.

Problems with the Gold Standard

The benefits of the gold standard were clear. It created a stable international monetary system that fostered the growth of trade and investment by guaranteeing that currencies had a fixed value. This predictability helped countries manage exchange rates and capital flows with more certainty.

However, the gold standard also imposed strict limits on governments’ ability to control their money supply. Because the amount of currency in circulation was tied to a country’s gold reserves, countries could not easily expand their money supply in response to economic needs without risking a depletion of their reserves.

The attempts to return to the gold standard after major wars, especially the Napoleonic Wars, World War I, and World War II, were fraught with problems that had significant economic and social consequences. These efforts provide a powerful illustration of how the rigidities of a gold-backed system clashed with the realities of war, economic hardship, and the changing needs of societies.

The role of commercial banks in creating money under the gold standard added significant complexity to an already fragile system. In the early days of the gold standard, commercial banks issued banknotes that were promises to pay gold to the bearer on demand. The challenge was that these banks had to hold enough gold reserves to back the banknotes they issued. However, they often issued more notes than they had gold, a practice known as fractional reserve banking. This allowed them to profit by lending more money than they physically held in reserves, but it created a dangerous situation: if too many people demanded their gold at once, the bank would run out, leading to a bank run.

There are stories from early American banking where gold was physically moved between banks to meet regulatory demands, especially ahead of inspections. This occurred primarily in the 19th century during a period of fragmented banking regulation, particularly with state-chartered banks. Some banks, struggling to meet the legal requirement of holding gold reserves sufficient to cover their circulating notes, would borrow gold from other banks temporarily. In extreme cases, banks would transport gold just in time to show regulators they had the necessary reserves, only to return the gold once the inspection was complete.

This practice highlights a key problem with the early banking system—many banks issued more notes than they could back with actual reserves. It created an unstable financial system vulnerable to runs and panics, contributing to frequent banking crises in the 19th century. This “game” of passing gold around only amplified these risks.

Such tactics underscore the difficulties faced by early banks in maintaining trust while issuing banknotes and the challenges of operating within a system that relied heavily on specie backing.

This led to periodic banking crises when public trust faltered, and people rushed to withdraw gold from the banks. These crises often required government intervention or emergency loans to prop up failing banks. Over time, most countries realized that a system of decentralized banknote issuance backed by individual gold reserves was inherently unstable. This led to centralization of banknote issuance, such as the Bank of England in the UK, the establishment of the Federal Reserve in the US, and other central banks worldwide. Central banks were better positioned to manage the money supply, maintain adequate gold reserves, and lend to private banks in times of crisis.

This solved some issues of instability by centralizing control of gold reserves, but it also imposed strict limits on government monetary policy. Since money creation remained tied to the amount of gold in reserves, governments could not easily increase the money supply during times of economic distress or growth.

This rigid system limited the flexibility of both commercial banks and governments to respond to shocks like wars or depressions. The gold standard’s reliance on bank-issued notes exacerbated these deflationary issues, as banks were forced to contract the money supply to maintain gold convertibility.

Post-Napoleonic Wars

After the Napoleonic Wars (1803-1815), Britain faced severe economic strains. The war had drained gold reserves, and the government was forced to suspend convertibility of banknotes into gold in 1797 under the Bank Restriction Act. During the war, the government issued large amounts of paper currency to finance the war effort, leading to significant inflation. Prices of goods skyrocketed, and the purchasing power of ordinary people diminished rapidly.

Once the war ended, Britain faced a dilemma: should they attempt to restore the pre-war gold standard, or should they adapt a new financial system? The decision was made to return to the pre-war standard of gold at the original value, but the deflationary policies necessary to achieve this were devastating. The government had to drastically reduce the money supply and reestablish trust in the pound’s value by converting currency back to gold. This caused a deep economic recession, marked by falling wages, high unemployment, and widespread poverty. The move severely restricted economic growth as industries, especially agriculture, struggled with falling prices.

This austerity-driven deflation laid the groundwork for political and social unrest, including the infamous Peterloo Massacre of 1819, in which British troops killed protesters demanding political and economic reforms. (The Peterloo Massacre is an interesting story itself.) Britain’s experience highlighted the social cost of maintaining a rigid gold standard that could not adapt to the demands of war and its aftermath.

Post-World War I

The problems encountered after WWI were even more severe. The war had bankrupted many European nations, and governments were forced to print money, abandoning the gold standard to finance the war effort. Hyperinflation became rampant in some countries, notably Germany, where the Weimar Republic experienced some of the worst hyperinflation in history. By the war’s end, the value of money was greatly diminished, and many countries found their economies devastated.

Nevertheless, Britain and several other countries sought to return to the gold standard in the early 1920s. Britain, under Chancellor of the Exchequer Winston Churchill, restored the gold standard in 1925 at the pre-war parity. The decision was economically disastrous. To maintain the high value of the pound relative to gold, the government had to engage in deflationary policies once again, slashing public spending and raising interest rates. This led to economic stagnation, falling exports, and high unemployment, particularly in the industrial north of England, where many workers found themselves out of jobs as industries cut back on production.

The problems were not confined to Britain. France, too, had to navigate its way through post-war monetary chaos. Although it did not return to the gold standard until 1928, the severe economic adjustments required to restore the currency’s value caused hardship, including political instability and social unrest. For countries that did return to gold, the experience was marked by economic contraction rather than growth.

The inflexibility of the gold standard during this period prevented nations from using monetary policy to stimulate their economies. Governments were unable to devalue their currencies or increase the money supply to create jobs and reduce unemployment. Instead, they were locked into a system that prioritized the stability of currency values over the well-being of their citizens.

Post-World War II and the Bretton Woods System

After WWII, the global financial system took a new direction. Rather than fully returning to a traditional gold standard, the Bretton Woods Agreement of 1944 created a modified system. The U.S. dollar was pegged to gold at $35 per ounce, and other currencies were pegged to the U.S. dollar. This was a compromise solution, as the world’s economies needed stability but also recognized that a rigid gold standard could not handle the demands of post-war reconstruction and economic expansion.

The system worked for a few decades, but by the late 1960s, the Triffin Dilemma began to expose cracks in the arrangement. Economist Robert Triffin had warned that the U.S. could not continue to run large trade deficits and supply dollars to the world while maintaining the fixed convertibility of dollars into gold. As U.S. deficits grew, confidence in the dollar’s value diminished. Foreign governments began converting their dollar reserves into gold, creating a drain on U.S. gold reserves. The United States, unable to supply both the dollars needed for global trade and the gold reserves to back them, was caught in an unsustainable position.

By 1971, U.S. President Richard Nixon announced the end of the dollar’s convertibility into gold, effectively dismantling the Bretton Woods system and marking the final transition to fiat currencies on a global scale. The end of Bretton Woods ushered in an era of floating exchange rates, where currencies were no longer tied to physical commodities but were allowed to fluctuate based on market forces.

The Consequences of Returning to Gold

The repeated attempts to return to the gold standard after wars highlight several critical issues. During wartime, countries had no choice but to print money and abandon gold to finance their military efforts. This increased the supply of money, often leading to inflation. However, the return to gold in peacetime required drastic reductions in the money supply to re-establish parity with gold reserves, causing severe deflation and economic hardship.

These economic policies disproportionately affected the working class and the poor, as wages fell and unemployment soared. The benefits of a stable currency did not outweigh the costs of economic stagnation, poverty, and political instability. By the mid-20th century, it became clear that the world’s economies needed more flexible monetary systems, capable of adapting to both war and peace.

The abandonment of the gold standard opened the door to the modern era of fiat money, which, though not without its challenges, allows governments to use monetary policy to manage inflation, employment, and economic growth in ways that were impossible under the rigid constraints of gold. There are economists, especially the Austrian economists, that advocate a return to the gold standard. In chapter 3, we will discuss the steps required to accomplish this. As we can see from above, this would usher in more difficulties than learning how to prevent inflation using fiat currencies.

Conclusion

In conclusion, the chapter illustrated how fiat money evolved from historical experiments to become the dominant form of currency worldwide. The rigidities of gold-backed systems, while providing stability, often caused significant economic and social hardships, especially during post-war recoveries. Fiat money, in contrast, offers governments the flexibility to adjust monetary supply to the needs of their economies, enabling a more dynamic response to economic crises and growth opportunities. Though fiat money carries risks, such as inflation, its advantages in modern economies far outweigh the challenges faced by gold-backed systems.