Updated 2 Oct 2024

Data

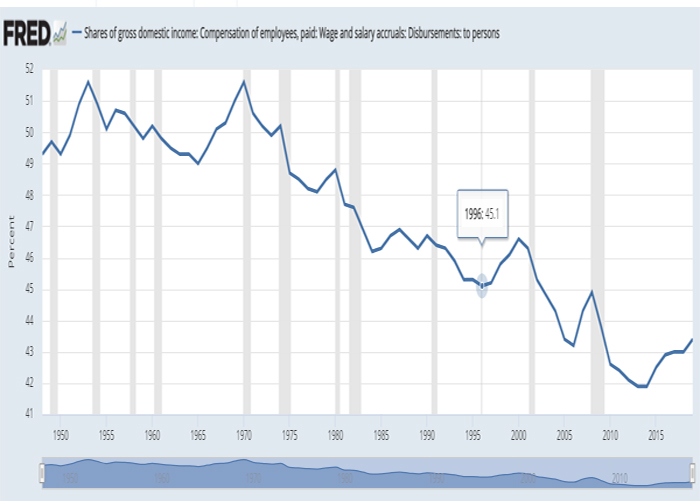

FRED:

The primary source of raw data is from the St. Louis Federal Reserve Economic Data (FRED). I originally calibrate most models by using FRED data.

Debt and Wealth:

The relationship between wealth and debt for the governments, households, and corporations are here: (All amounts are in Billions. Growth rates are per annum, i.e. exponential.) The 62 years between 1946 and 2008 is the baseline. 2008 is the cutoff because so many Fed actions after 2008 distort the data collected prior.

Household Wealth: https://fred.stlouisfed.org/series/TNWBSHNO 1946: $885; 2008: $65,544; Growth rate of 6.95%

Household Debt: https://fred.stlouisfed.org/series/CMDEBT 1946: $36; 2008: $14,321; Growth rate of 9.6%

Corporate Wealth: https://fred.stlouisfed.org/series/TNWMVBSNNCB 1946: $232; 2008: $14846; Growth rate of 6.7%

Corporate Debt: https://fred.stlouisfed.org/series/BCNSDODNS 1946: $24; 2008: $3,491; Growth rate of 7.95%

Government Wealth: https://fred.stlouisfed.org/series/FGNETWQ027S 1946: -$114; 2008: -$5,009; Growth rate of -6.1%

Government Debt: https://fred.stlouisfed.org/series/FYGFD 1946: $323; 2008: $9,914; Growth rate of 5.5%

Combined Non-government Wealth: 1946: $1,117; 2008: $80,390; Growth rate of 6.9%

Combined Non-government Debt: 1946: $61; 2008: $17,812; Growth rate of 9.15%

Overall Wealth: 1946: $1,002; 2008: $75,380; Growth rate of 6.95%

Overall Debt: 1946: $384; 2008: $27,725; Growth rate of 6.9%

Treasury’s General Account Balance:

There is an interesting graph in the federal government’s general account. Prior to 2008 the balance was nearly always about $5 billion. Starting in 2008, that balance suddenly had positive values of a few hundred billion dollars. A sudden spike occurred during the pandemic. The peak value was on July 27, 2020 with a value over $1.7 trillion. It took a while to track down but there was a huge spike in demand for treasuries–the wealthy wanted to keep their money as liquid as possible and treasuries are the safest way for them. The treasury issued more treasury securities to satisfy the demand and just kept the money in their general account.

Website Articles/Pages

Steve Keen:

In this article, Steve Keen berates those who think that because interest is not created when the money is created, the money supply must constantly increase to pay for the interest payments. If you look at the exponential rise in debt, it is easy to come to that conclusion. I came to that conclusion myself until I closely examined the creation and destruction of money.

Money comes from two sources; banks create money when they lend it into existence and central banks create money when they purchase debt from governments or the public. In the case of the central bank money creation, the money created is placed in reserve accounts.

Destruction of either of those monies occurs as loans are repaid. As loan payments are made to banks, the principal portion of those payments causes a destruction of that amount of money and removes it from circulation. The interest portion of that payment is used by the bank to pay employees, pay dividends, pay vendors, make capital investments, or purchase other assets. As such it circulates back into the economy.

Because the interest payment needed to be borrowed but then that interest circulates back through the economy, there is a slight increase in the demand for currency because of the interest being borrowed. This amounts to the square of the average interest rate. For an average interest rate of 6%, this growth would be about 0.4%.

Something interesting happens when you look at the destruction of the money created by the central bank. The purchase of debt by the central bank causes the seller of the debt to have their bank account increased by the amount of the principal. The seller’s bank receives a corresponding increase in their reserve account. If that debt is from a private source, the payment made by the borrower goes to the central bank. To receive the money, the central bank takes the entire payment, principal plus interest, out of reserves of the borrower’s bank. This removes both principal and interest out of circulation through the economy. While the principal part of the loan payment destroys that amount of money held in reserves, the interest was not destroyed, but is held at the central bank forever out of the reach of the economy. In essence, the interest portion of the payment was transferred across the “reserve barrier” to be forever out of reach of the economy that created that money.

The repayment of public debt held by the central bank, those treasury securities, moves interest across the reserve barrier as well but it involves moving money out of taxpayers accounts and into the government’s spending account, the Treasury General Account (TGA) in the U.S. Repayment of the debt destroys the principal amount but the interest stays in the books of the central bank.

Given the complexity of the creation, destruction, and movements of money, it is not surprising that people draw incorrect conclusions about what happens to money borrowed to pay interest.

Richard A. Werner:

Mainstream economists think banks need to receive depositor’s money before they can loan the money out. This implies that writing a loan does not create new money, only distributes money already existing in the economy. Richard A. Werner refutes this with empirical data in this article. It also refutes the contention that the collective action of banks creates the money even when a single bank does not. He shows a single bank writing the loan creates the money.

Ask any AI how money is created and it will claim that money placed in bank reserves allows the bank to loan out multiples of that increase in reserves. The AI has been trained on information on the Internet and this explanation is widespread there. Since a bank that receives a deposit from another bank only needs a fraction of that amount to hold in reserves, the remainder is excess reserves. A bank can easily lend an amount to create deposits equal to 1 minus the fraction required to maintain reserves. This is how fractional reserve banking is explained.

But when considering the entire banking sector, whatever gains one bank receives from a new deposit, another bank is in the opposite position. Removal of bank reserves for that bank means that additional deposits must be secured or some means of replacing those lost reserves must be found. The overall level of the money supply hasn’t changed.

Some may try to explain that it is government spending that starts the injection of money into reserves and those reserves then get multiplied. If the government has a balanced budget, whatever money has been spent into reserves is removed by taxation and so the net is no new reserves to multiply. With deficit spending, there are new reserves that can be multiplied, but it is not done in the way described by the fractional reserve lending explanations.

Reserves are an asset to the bank and their lending limits are controlled by the health of the bank’s balance sheet. The process of writing the loan creates new money from thin air. There is no attachment of deposits in the process. Thus, the fractional reserve explanation is highly misleading.

GDP:

The consumption calculation of GDP plays a prominent role on this site in identifying problems with the role money has played in economies. This equation is: GDP = G + C + I + (X – M) where G is government consumption, C is private consumption, I is corporate investment, and (X – M) is exports minus imports (i.e. foreign trade).

But GDP is a poor measure of economic production. The Income calculation for GDP is GDP = NI + ST + D + NFF where NI is national income, ST is sales taxes, D is depreciation, and NFF is net foreign factor income. NI is the sum of wages, rent, interest, and profits. NFF is the difference between what our companies earn overseas minus what foreign corporations earn here. The income calculation and the consumption calculation don’t match even when adjustments are made to the numbers.

I think the biggest problem in reconciling those numbers is that sales of anything used–cars, houses, factories, etc.–are not included in the consumption calculation of GDP. Yet these used products participate in production and produce income.

Money as debt:

L. Randall Wray, one of the founders of the MMT school of economics has declared that all money MUST be debt. Late in the article he claims that maintaining a Zero Interest Rate Policy (ZIRP) forever is equivalent to debt-free money. I disagree that money must be debt. History shows examples of money that was created without debt.

I maintain that the only rationale supporting Wray’s contention that money must be debt is the Stock Flow Consistency (SFC) requirement of MMT and that is easily remedied. ZIRP and debt-free money are far from equivalent. The requirement for renewal renders a ZIRP debt instrument different from debt-free money. Changes in policy can remove ZIRP. ZIRP bonds have no incentive for the purchaser so in the long run it will be difficult to market them. The implementation of ZIRP but then paying interest to banks on their reserve accounts defeats the purpose of ZIRP and creates other problems.

The biggest problem to ZIRP is that there is no incentive to convert dollars to debt. This threatens the preeminence of the US dollar overseas. With ever growing deficits, people want to hedge against inflation by converting dollars into something safe that earns interest.

Most foreign governments have no use for dollars within their own country. They generally can’t circulate them beside their own currencies so they park them at their central bank and their central bank purchases interest bearing treasuries. If those securities don’t earn interest, they may choose to invest those dollars back into US properties or businesses–more risky, but they may at least earn something for that idle money.

Minsky:

Steve Keen’s Minsky program created all the models used on this site. This is a free program with source code available. Properly used, this program will guarantee that your models follow Modern Money Theory’s (MMT) Stock Flow Consistency (SFC) requirements. (Minsky has been upgraded since writing models cited in the models pages. I’ll try to get them updated.)

Ownership of Central Banks:

This article identifies a little of the history and ownership of central banks. My site finds the issue of ownership mostly irrelevant in the larger economic picture. It is the abdication of government sovereignty over money that is a bigger problem. This can be remedied by changing the laws forbidding the treasury to write checks without cash in their Treasury General Account (TGA). While not the best solution, it is far better than our current system.

Some people advocate minting the trillion dollar coin as a solution since the accounting for coins is different than for writing a treasury security. However, think about who would take that trillion dollar coin. Most likely it would be the Fed. Then, sometime in the future, the Fed, because they are a private entity, will want to redeem that coin and the Treasury would have to write a trillion dollars in treasury securities.

It would be better for this solution if the treasury issued 10 billion $100 platinum coins or 100 billion $10 platinum coins and circulated those. This strategy isn’t the best solution–best is to just change the law to allow for debt-free money.

Federal Reserve Act:

The Federal Reserve Act outlines the creation of the Fed. It is an interesting read. That’s normally not something you can say about an act of congress.

For a detailed look at how the Fed works, this Investopedia web page is the first of 23 pages that describe the functions of the Fed. To access the other 22 pages, scroll down past the “Article Sources” section. Links throughout those pages provide additional information not found on the pages themselves.

In page 2 of this series, they give the impression that all central banks are government owned but fail to mention that the Fed is owned by its member banks, some of which are foreign banks. The ownership by banks isn’t as critical as it seems but decisions made might be slanted a bit (sarcasm) to favor banks instead of the government or the public.

Throughout the series, there is no distinction between money creation and money circulation. They assume increasing money circulation through the economy is equivalent to money creation. Understanding money creation is critical because it is created as debt while money circulation just moves it (primarily) in or around the commercial banking system.

Modern Money Theory: A Critique:

Warren Coats of the Cato Institute offers this critique of Modern Money Theory (MMT). One valid point Coats makes is that adopting MMT principles would shift monetary policy from the Fed to the Treasury. Control of the amount of circulating money would be more dependent on spending (fiscal) policy than on interest rates. My opinion is that “how to control the politics” surrounding spending should be sparking greater debate among MMT proponents.

I’ll try to find time to write a post on this critique. I have my own critique of MMT.

Sonnenschein–Mantel–Debreu Theorem

I ran across this theorem in the MMT Activist podcast from June 13, 2021. This is a theorem that disproves that there is an equilibrium point for economic systems. Neoclassical economics inherently assumes there is some equilibrium point. (The Dynamic Stochastic General Equilibrium model (DSGE)).

In Steve Keen’s book, Debunking Economics, he mentions that this theorem also demonstrates that supply and demand curves can take any shape except one that crosses over itself. Those beautiful supply and demand curves you learn in your introduction to economics class are totally BS.

The primary reason there is no equilibrium point in any economic model is that money, the driver of all economics, is being created exponentially as debt rises exponentially. Subsequent uneven distribution of that money circulation guarantees there can never be an equilibrium point.

Reserve Release

I’ve recently run into the term, Reserve Release. Here’s an article about it. I’ll have to study it a little more.

World Clock

Here’s an interesting website that has a running total of things like public and private debt, taxes, defense spending, Medicare spending and obligations, number of jobs, unemployment, population, etc.

Just a few things I found interesting. In the middle of July 2022, total personal debt was equal to GDP. Total debt, governmental and private was $91.6 trillion or 390% of GDP.

Currency and credit derivatives total $607 trillion. Another website has the 2021 total worldwide GDP of $96 trillion. The derivatives total in 2000 was $91 trillion, so current derivative levels are 667% higher than 20 years ago. These derivatives are part of what caused problems in the 2008 crash.

The US has $170 trillion in unfunded liabilities with a GDP of $23 trillion. US debt to GDP ratio in 1960 was 52.6%, in 1980 was 34.6%, in 2000 was 57.1%, and now is 129%. When you add in state and local government debt, it’s 144% of GDP.

40 million people are living in poverty of the 333 million people (12%) The officially unemployed is about half of the actually unemployed. Median house prices went up by 260% while median wages went up 12.5%.

M2, a measure of money, went from $4.8 trillion in 2000 to $20.7 trillion now. This shows a 431% increase in the most common measure of money–money that circulates the most. Compare that with the 12.5% increase in median wages.

You can also check back for the values for several different years on the same date as early as 1980. I talk about exponential growth in several economic areas causing problems for the economy, but a look at this website can point to a number of different problems that won’t go away without a change in the system.

Mises (Austrian Economic School)

True Money Supply

This paper touts the Austrian school’s superior predictive power of impending recessions by using “True Money Supply” (TMS) instead of the inverted yield curve. I find the Austrian School wrong so often I don’t know if I can evaluate this article objectively enough. I’ll mull it over and maybe write about it. I did notice their counting of money does some double counting because they don’t understand how money is created.

On Taxes

In this article, Ryan McMaken opines about the federal debt ceiling. He thinks the government spending is strangling the private sector by its deficit spending. The problems with government deficit spending is far more complex.

Bank reserves create a barrier to the free movement of money. Since only the Fed can change bank reserves, once money is in reserves, there are limited ways of getting that money back out of reserves. Banks can take that money out in cash (reserve notes and coins), but the other ways require paying back debt.

Government spending moves money from bank reserves into the Treasury General Account (TGA) and then when spent it goes back into bank reserves. If the borrowing amount and the spending amount are equal, there is no net change to bank reserves.

The money the government spends (generally) goes into private bank accounts. The process of borrowing removed that money from reserves and then put it back in reserves. The banking sector has the same amount of reserves as before the borrowing/spending but has a new financial obligation–to provide the money to the recipient of that spending.

Because the books must balance, what the banking sector got in exchange is a debt instrument (a treasury security). Unlike bank lending, which creates new money when it generates a debt instrument, government borrows before spending. That debt instrument cannot be spent in the general economy but can be used to back additional lending or purchase of other financial instruments, which equally cannot be spent into the general economy.

If you think about the process, any loan, even a loan to your brother, creates a double claim on the money lent. It was created by a bank loan, but before it can be used to repay that original loan and destroy that money, it first must circulate to that secondary borrower so the second loan can be repaid. Of course, money is fungible, so those same dollars do not have to circulate back, but in the macroeconomic sense, those dollars form a double claim.

The Austrian school assumes that governments are “printing” money when they spend. If only that were true; we would have a much healthier economy. Government spending starts a much more intricate dance of borrowing and circulating the debt instruments and creating a complex web of financialization of the economy.

Tax Tyranny

Another article reviews a book, Tax Tyranny, by the French economist, Pascal Salin. You can get the gist of the book from the first chapter. I agree with Salin that a poll tax can’t generate enough income for a modern state and that income taxes are a disincentive to raising your income. When considering income taxes, the Laffer curve holds–when rates are excessive, lowering rates will increase tax revenue. It would also hold for sales taxes.

What Salin never considers is other taxing methods. On this website we advocate taxing transactions. Financialization of the U.S. economy has so distorted money circulation that an economy generating GDP of $28 trillion has over $7.6 quadrillion (1000 trillion) in total transactions. Even being generous in allocating transactions to GDP shows that GDP is a rounding error to total transactions.

A flat tax of 25 cents on every 100 dollars would allow the government to balance its budget, repair all its infrastructure, pay for higher education through PhD levels, fund healthcare for all, expand research, provide for Universal Basic Income (UBI), eliminate income, sales, and property taxes, and so much more. By taxing transactions, there would be few ways of avoiding paying taxes.

Salin dislikes progressive taxes. The above proposal to tax transactions would be flat for everyone. Since the wealthy keep and move larger amounts, they would pay higher taxes but the rate would be flat.

Taxing inheritance should be progressive. Without inheritance taxes we allow dynasties. An egalitarian society doesn’t need dynasties.

The article about this book claims Salin’s point is that to tax at all is tyrannical. What is more tyrannical is a system that requires money creation to be through borrowing. This creates a system in which the more money that is created, the greater the negative effect on the macroeconomy. The more money created, the larger the debt burden.

Some Austrian’s argue that we should eliminate government entirely. Most of us agree that position is absurd–that means no laws, no courts, no rules, total anarchy, feudal lords ruling us, private security, etc.

Papers

Working paper 891:

Levy Institute’s working paper 891 surveys some MMT models. It identifies the concepts of Stock Flow Consistency (SFC) and quadruple bookkeeping entries. Proper use of SFC identifies “stocks” of money within each sector of the economy. The model moves “flows” of money from one stock to another. Since every asset stock in one sector has a corresponding liability stock in another sector (and visa versa), the double entry bookkeeping for each sector results in four entries for each flow transaction. Quadruple bookkeeping ensures that the model has no unaccounted sources of input. If all assets minus liabilities minus equity equals zero, this mostly meets SFC requirements.

SFC explains MMT’s claim that government deficit spending benefits the economy. By the government reducing taxes, it leaves more money for us. Since the government has unlimited borrowing capacity, we can forever continue deficit spending. That logic has some flaws as we will examine in blog posts.

Working paper 961:

Levy Institute’s working paper 961 by L. Randall Wray describes the “Kansas City” approach to Modern Money Theory. This describes the history and key concepts of MMT and proposes a jobs program as an integral part of MMT. The jobs program would ensure full employment at all times. It would place a floor on wages without need for a minimum wage law. It would provide a pool of trained employees that could transition into private employment.

For well over a century, workers have felt the brunt of monetary and fiscal policy. When the economy is expanding too fast or has a bubble, the Fed raises interest rates until unemployment rises enough to keep people from purchasing products or borrowing money. When the Fed needs to stimulate the economy, lower interest rates allow hiring again. MMT’s jobs program prevents using workers as a tool of economic policies.

However, the jobs program by itself would exacerbate the inequality. It would be implemented at the state and local level through public/private partnerships. This would substitute market forces for bureaucracy and graft. The money flow to the wealthy would just get larger. This shifts the tax burden further down.

Enacting government programs similar to what was done during the depression where the government itself provides the jobs would lessen the impact but distort markets as government creation of goods or services would compete with private enterprise.

IMF:

This paper about international monetary stability advocates using Special Drawing Rights (SDRs) as a reserve currency instead of the US dollar. Using the dollar as the reserve currency creates current account (foreign trade) issues for the US. Since the dollar is used as a reserve, the number of dollars needed to satisfy worldwide demand creates an escalating outflow of dollars to satisfy the reserve requirements. This Wiki article about the Triffin Dilemma explains the problem.

Keynes identified that this would be a problem during the Bretton Woods agreement which set the US dollar as the reserve currency to be the intermediary to converting to gold. He proposed using a worldwide currency he called the bancor.

The IMF paper offers short-term, medium term, and long-term solutions to eliminate the instabilities unbalanced currency flows cause. In general, I’m leery of giving power to global entities.

SDRs are not a solution anyway because all of the contributors to the SDRs are using debt based money. The solution to the instability in modern economies is to eliminate the exponential demand for money by creating money debt-free.

The proposals to create Central Bank Digital Currencies (CBDCs) makes this article dated. There will be upcoming blog posts on CBDCs.

ECHENIQUE, et al:

Steve Keen, in his book “Debunking Economics,” cited Reinhard Sippel as disproving rational choice by consumers. As I did more research, I found that Sippel had done a lab experiment bringing in some people and gave them a choice of what they could consume. (See here,) In the process of checking this out, I found this paper by Echenique, et. al. which uses a concept they call the money pump index (MPI) which measures real world rational choices. I much prefer real world data over lab data.

To find further information on testing rational choices, the term to search for is GARP (Generalized Axiom of Revealed Preferences.) The concept of the money pump index is that if people made irrational choices, there is a theoretical (or possibly real) arbitrager who could make money by more cheaply buying the things you chose and sell them to you and still make a profit.

While I take issue with Echenique’s article’s failure to label the vertical and horizontal axes on their charts, these researchers found that irrational choices were minimal. While I admire Keen and his work, this article seems to refute one of the conclusions in his book. I wish I could ask Keen about this.

Paul Cole:

This paper is one of the best summaries of the decline of the middle class in the US. I don’t agree with all his solutions for fixing the problems, however. Certainly, bank and financial sector reform is needed. State and regional governments should have public banks. This allows them to create money from nothing, but, like the federal government, they need to tax to remove the excess (i.e. repay the loans.)

Cole is under the illusion that the stock market funds businesses. That happens only for IPOs or new stock issues. He wants a transaction tax to eliminate short term trading. He thinks that would raise tax money without making much difference except to the rich people trading stocks. A tax on transactions solely in the stock markets wouldn’t help corporations much except the CEO compensation often depends on stock prices. The tax may moderate those. A transaction tax would remove money from the economy so it could lower the tax rate for others. Instead of just taxing stock purchases, a general tax on transactions would raise far more in taxes and allow us to eliminate income taxes.

Cole’s concern for drug prices is too limited. We need to question if health care insurance and drug production should even be part of a “for profit” system. Drugs that cure don’t generate lasting revenues so drug companies will stifle their production. And “for-profit” health insurance makes more money if they deny coverage even though the premiums have been paid.

The tax changes Cole proposes basically keep the inefficient tax structure in place, just reforms some rules and rates. Along with tax reform, we need a reform of how money is created. A transaction tax would provide a century or more of time to evaluate alternatives.

His education reform is too limited. Education should be free for all from pre-K to PhD level. Those that don’t want formal college should have trade school tuition paid.

Despite my criticisms above, the paper is a good read.

Books

L. Randall Wray/MMT:

L. Randall Wray is one of the founders of Modern Money Theory (MMT). His book, “Modern Money Theory: A Primer on Macroeconomics for Sovereign Monetary Systems”, ©2012, Palgrave Macmillan, is a primary source of information on the principles of MMT. He has a more recent book, Macroeconomics, ©2019, Red Globe Press, written with William Mitchell and Martin Watts.

Modern Money Theory is a good introduction to MMT. While I have my disagreements with MMT, it is the only economic “school” that studies modern fiat money responsibly. They downplay the creation of money which detracts from its usefulness.

Steve Keen:

Steve Keen’s book, “Debunking Economics“, ©2011, Zed Books, was one of the books that inspired me to take another look at economics. I learned in undergraduate economics courses and reading articles on economics that there is no “science” in economics. It is mostly hot air–probably the same hot air that creates money. Keen does expose this lack of science.

Ellen Brown:

Ellen Brown’s “Web of Debt,” ©2011, Third Millennium Press; 4th edition identifies debt as a primary problem with economies. This book will give you the best education on the problems of debt-based money. Critics of the book mainly nit-pick on minor stuff. Overall, this is an excellent read.

Ellen Brown’s “The Public Banking Solution,” ©2013, Third Millennium Press, 1st edition identifies a solution for financing local and regional governments. While MMT claims that sovereign governments can borrow as much money as they want without repayment, local and regional governments cannot finance their operations the same way. They need to balance their budgets in the long term. One way of reducing costs is to establish a public bank.

G. Edward Griffin:

G. Edward Griffin’s “The Creature from Jekyll Island,” ©2010, American Media, 5th edition exposes the secrecy and conspiracies surrounding the implementation of the Federal Reserve Act (FRA) of 1913. Griffin contends that the Fed is the cause of the evisceration of the middle class. The FRA represents an abdication of our government’s ability to create its own money. Instead, the only money created is through bank lending.

The creation of money by bank lending has spread virtually through the entire world. For peace and prosperity, reform would need to be implemented worldwide.

Stephanie Kelton:

Stephanie Kelton’s “The Deficit Myth“, ©2021, Hachette Book Group, Inc., identifies how sovereign governments create money (they spend it into existence). They do not need to “find” or “pay for” money to spend it. This book is an excellent introduction to MMT.

However, the money created by government spending is in the form of a treasury security. The concept of circulating debt as money forms the basis for the financialization of the economy. This financialization has expanded to such proportions that when the financial markets hiccup, the productive economy shudders. It is the tail wagging the dog.

The contention that taxation destroys money is also bogus. One measure of money (base money) defines money as the sum of money in bank reserves plus coins and currency. When paying taxes, money is transferred from bank reserves to the treasury general account (TGA). Since the amount in the TGA isn’t considered base money, paying taxes destroys base money. When those taxes are used to repay treasury securities, it destroys the treasury securities and thus the debt that is circulating as money.

The only way to destroy money is to repay debt. When that is bank loans, it removes money circulating in the productive economy. When it is debt that circulates in financial circles, it destroys some financial money circulation.

Murray N. Rothbard:

Man, Economy, and State with Power and Market is a massive tome (1438 pages) which outlines the principles of the Austrian school of economics. Beginning on page 1047 is a rationale for the conditions necessary for a free market. The Austrian school believes that any intervention by government distorts free markets but Rothbard’s requirements are internally contradictory and would require government intervention to maintain the conditions.

At some point I’d like to do a critique of Rothbard’s book and/or Austrian economics. To do that, I need to condense what he covers in 1400+ pages to a few hundred words. Since so much is hot air, maybe I can do that.

Irving Fisher:

This depression era publication identifies nine key economic influences on economies. These are over-indebtedness, price disturbances, amount of circulating currency, the velocity of currency circulation, net worth, profits, trade, business confidence, and interest rates. Without the first two, Fisher believes severe disruptions of the economy will not happen.

With the current system of money creation, over-indebtedness will always exist so his first of the two influences can never be eliminated. The exponential rise in debt (and money) fuel price disturbances so the second is also unlikely to be eliminated.

Fisher emphasized a dynamic economy which was in contrast to the prevailing economic theories of that time. His search for cycles led him to propose a constantly dynamic economy. The prevailing thought was the that dynamism occurred only in the transitions between stable states. Because of how money is created, there are no stable states to transition between.

Carl Menger:

While the Austrian school of economics is wrong, at least they have a coherent, consistent approach to economics. This book, written in 1871, is written by the founder of the Austrian economic school. It is easy to read but rather tedious. He spends the first 50+ pages defining what a “good” is and another 50+ pages on how we assign value to a good.

He comes to the bizarre conclusion that since we can only apply value to scarce goods, non-scarce things, like public education or our potable drinking water supplied to our homes, have no economic value. These are not considered scarce goods because they are universally available for anyone to take in whatever quantities they want.

Even back in his day, if I had written that down, I would start rethinking my logic. Tell an employer or taxpayer that public education or our water supply have no value and try to answer why they must pay for them.

John Calhoun:

This pre-civil war era publication, “A Disquisition on Government…”, identifies the need and requirements for constitutions. I’m only about 50 pages into it, but it seems a well reasoned book written by a southern congressman from South Carolina before the civil war. I’ll be interested to see his take on states’ rights.

Rutger Bregman

This book, “Utopia for Realists,” proposes a 15 hour work week, Universal Basic Income (UBI), and open borders to create a utopia we’ve been moving toward since the 19th century. In many ways we have achieved what a peasant in the 1300’s would have regarded as utopia.

Joseph Wang

This book, “Central Banking 101,” identifies 4 types of money, money in your wallet, money in your bank account, money in bank reserve accounts, and treasury securities. This book was instrumental in identifying the nature of the reserve barrier.

Videos

Bank Positive Equity:

Steve Keen identifies that all banks must have positive equity. Here it’s at 3:37 and here it’s at the beginning of the video. The first of those videos is the start of a series of videos where Keen constructs a fairly complete economic model. If you want to learn how to use the Minsky program to construct economic models, these videos are a good place to start.

Steve Keen Macroeconomics:

Steve Keen critiques neoclassical economics for their insistence that macroeconomics must build up from microeconomics. In his book, “Debunking Economics,” Keen notes that the extrapolation from micro to macro economics introduces errors in part because small errors when multiplied by millions become large errors. Also, the whole is more than the sum of its parts. Even extrapolating from a single individual to a second individual creates errors.

In this video, Keen defines macroeconomic relationships as equations, differentiates them, and uses the resulting equations to create a dynamic model. Find a recreation of his model here.

Podcasts

Barron’s/MMT:

This podcast is one of the better interviews with Stephanie Kelton I have heard. Stephanie Kelton is one of the major proponents of MMT. Her book “The Deficit Myth” (see “Books” above) describes how governments don’t need to “find” sources of the money they spend.

Pitchfork Economics

This podcast identifies some economic facts about the relationship between pay scales and unemployment. Contrary to mainstream economic claims that increased wages cause unemployment, unemployment actually decreases with higher wages. Andrew Yang points out that UBI is a better stimulus to the economy than a jobs guarantee because some of the jobs done (specifically home child care) do not qualify as a reimbursable job while UBI ensures money to everyone.

Debunking Economics #252

Podcast #252 reviews some recessions. It identifies the cause of the most severe recessions as a change from high positive credit to negative credit. While high debt before the 2008 crash became unsustainable, it is the availability of credit from positive to negative that sustained the recession.

The primary cause of sustaining the recession is that the banks were bailed out but the middle class was not. All the money introduced into the economy went into financial money circulation which soon brought the financial circulation back to normal. The wealthy were made whole while the rest of us were not.

After foreclosures on their homes (and businesses) banks didn’t want to loan much in the general economy and borrowers were in no condition to ask for loans.

The vast amount of money removed through foreclosures was never made up. Since money is created by borrowing, we can see the loss of money supply in this graph.

Debunking Economics #219

Podcast #219 has Steve Keen identifying that he has accepted MMT’s claim that government spending creates money. His reasoning is that, just like a bank, the government issues a debt instrument and in exchange receives cash in the bank. I

I

Articles Needing Text

https://www.richmondfed.org/publications/research/economic_brief/2024/eb_24-01

https://mises.org/mises-daily/fiasco-fiat-money

http://thorstenpolleit.de/qjae14_4_1.pdf

https://mises.org/mises-daily/fiasco-fiat-money

https://onlinelibrary.wiley.com/doi/full/10.1111/twec.13028