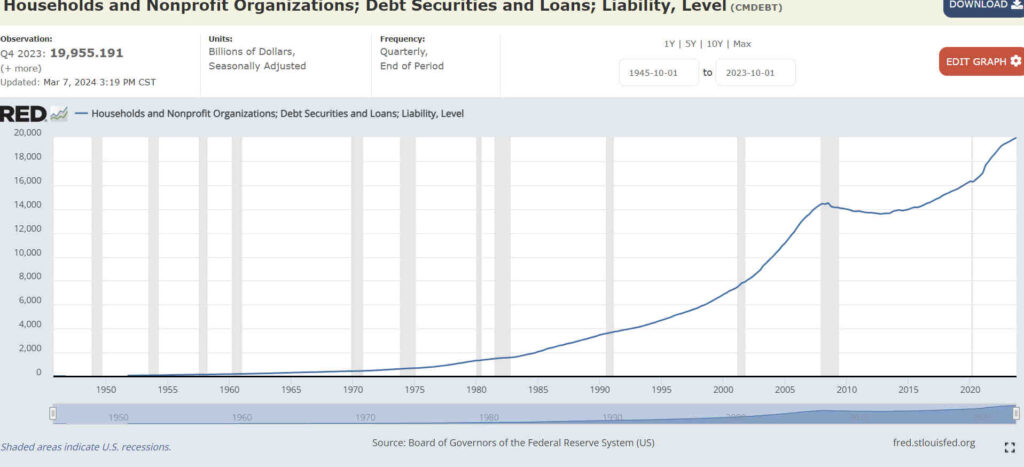

Federal Reserve Economic Data showing household and nonprofit debt from 1946 to 2023. Using the Excel RRI function, this shows debt rising 8.8% annually for 77 years. https://fred.stlouisfed.org/series/CMDEBT No amount of thrift or discipline will prevent this type of debt growth. It is part of the system structure.

This post summarizes the problems created by our current system of creating money. It offers only the barest outlines of a solution. The bullet points were created when I presented a politician with a 15 page explanation of the problem with our system of creating money and she said she just wanted “bullet points.”

Each bullet point is numbered. Following the bullet point list, a more detailed explanation can be found below corresponding to each number. Those explanations are not sufficient for understanding everything about money, but will offer an inkling of what is or will be covered on this website. Most of the information is based on the US system, but the problem is universal.

These problems are the reason for this website. It is intended to spur discussion and debate.

Numbered Listing–1-8 (creation), 9-10 (destruction), 11-15 (the Fed), 16-28 (the economy)

-

- To understand money, you need to understand balance sheets, compound interest and debt.

-

- Joseph Wang defines 4 types of money.

-

- In these bullet points, we will divide money as either cash or treasury securities.

-

- There are two sources of cash: banks writing loans and the Fed purchasing debt.

-

- Banks create cash by writing loans.

-

- All sources of money incur compounding interest.

-

- The payment of interest through borrowing is hidden.

-

- Because interest payments are borrowed, debt rises exponentially.

-

- Paying back principal on a loan destroys that amount of money in the economy.

-

- Paying taxes transfers money from bank reserve accounts to the treasury.

-

- The Fed interacts monetarily with banks through their reserve accounts.

-

- US banks and money creation became unified under the Fed in 1913.

-

- Government spending creates new money in the form of treasury securities.

-

- The Fed can convert treasury securities into cash.

-

- The Fed inefficiently controls economic growth by controlling interest rates.

-

- Economic growth can never keep pace with debt growth.

-

- Inequality is built into the system of debt created money.

-

- No amount of thrift or taxation will pay down total debt or create equality.

-

- Inequality creates inefficiencies in the economy.

-

- Currently 40% of the population barely contributes to economic spending.

-

- Workers are used as pawns to control the economy.

-

- Bankers control whether they will create cash by deciding to loan money.

-

- Taxing income or sales is an inefficient way of collecting taxes.

-

- Taxing money transactions is a more efficient way to raise taxes

-

- Savings and investments are not equal.

-

- Financial assets are considered wealth, but they are just paper used to create real wealth.

-

- The stock market does not generally provide money to corporations.

-

- The current system of creating money will fail.

Money Creation

1. To understand money, you need to understand balance sheets, compound interest and debt.

Bankers have worked for over 300 years to create the current system of creating money as debt. Only 3 countries have resisted, Iran, Cuba, and North Korea. Some other late holdouts were Libya, Iraq, Iran, and Venezuela. Note that they faced condemnation and/or war from the western world. Coincidence?

Money is created by entries on a bank’s balance sheet. Money to pay interest is not created at the same time so interest compounds as the interest is borrowed. Since every source of money depends on promises to repay it as a loan, all money has its origins as debt.

2. Joseph Wang defines 4 types of money.

Joseph Wang, in his book, “Central Banking 101,” describes 4 types of money:

-

- the paper money you have in your wallet (he calls that fiat money, but fiat money is more than that. Worldwide, all our money since 1971 is fiat money),

-

- bank deposits,

-

- bank reserves,

-

- and treasury bills, notes, and bonds (treasuries).

Most of us are familiar with paper money and bank deposits while the other forms are a little less well known. You may have treasury securities or a “cash fund” in your IRA or 401K which uses treasury securities to keep your money liquid. Bank reserves are discussed below as is more detail about treasuries.

3. In these bullet points, we will divide money as either cash or treasury securities.

In these bullet points, only treasury securities will be considered as different from what we will call cash. All 4 forms of money are fiat currencies because they are not backed by a commodity (like gold, for example). Treasury securities generally require conversion to cash before participating in productive economic activity (as opposed to financial economic activity).

Bank reserves in a bank’s main account with the Federal Reserve (the Fed) are transferred there through the sale of a debt. The reserves transfer from bank to bank so any particular bank’s reserve account fluctuates. Total bank reserves decline as debt held by the Fed is repaid or more debt is sold by the Fed than is purchased by the Fed.

Bank reserves originated as a hedge against bank runs. If too many depositors ask for their money all at once, banks would be unable to provide cash to them. The banks were required to keep a reserve against such situations. Those reserves are held at the Fed and only Fed actions can change those balances.

Wang describes bank reserves almost like an iron wall between the Fed and money circulating in the economy. This “reserve barrier” results in money accumulating on the Fed side of the barrier that can only be recovered as wallet money. Going to a cash-free economy reduces the ability to remove money this way.

The money accumulation on the Fed side of the barrier is because the money created by the Fed to populate those reserve accounts earn interest and since the repayment of debt destroys only the principal amount, the interest has no way of being recovered. Even if that money is returned to the Government, the government also operates on the Fed side of the barrier. That accumulated money comes from money that was created by borrowing by the general public. It is a net drain to the productive economy.

Another way money is depleted from reserve accounts is by taxpayers paying their taxes. The amount of the tax is removed from the taxpayer’s account at the bank and that money goes from the bank’s reserve account to the treasury’s general account (TGA) (or into Treasury Tax and Loan (TT&L) banks.) This money is not destroyed, only stays ensconced our of circulation by the government.

4. There are two sources of money: banks writing loans and the Fed purchasing debt.

The federal government pays for its goods and services by drawing on its TGA. If the TGA needs to be topped up, the treasury issues treasury securities (adding to the public debt) which the Fed auctions to a group of 24 securities dealers. These treasury securities can be converted into cash by selling the securities to the Fed. This process is described in detail in point #14.

5. Banks create cash by writing loans.

Banks do not loan out depositor’s money. The balance sheet entries show no assets are accessed when posting a new loan. See Richard Werner’s article.

There are other lending entities which lend without creating money., If you borrow money against your insurance policy, the insurance company does not create new money. The amount they loan you comes from assets they own. Borrowing from your brother-in-law does not create new money. Banks have a special franchise given to them by the government to create money by lending.

6. All sources of money incur compounding interest.

Since banks create money in the amount of the loan that created it, the money to pay the interest on that loan must come from somewhere else. All the circulating money came from loans similarly creating so the interest from all these loans must be borrowed. The net effect is a demand for money that equals the effects of compounding interest.

Since the principal part of a loan payment destroys that amount of money, to keep the money supply growing, the total of new borrowing must total at least the amount of all loan payments, principal plus interest. Think of how fast your debt would accumulate if you told your banker each month that you didn’t want to make the loan payments but wanted to just add on the interest payment to your total debt. Each month you would be paying interest on the interest you had borrowed. The equivalent is what happens in economies around the world.

The other source of money comes from the Fed purchasing debt. First consider when the Fed purchases private debt. Since the money from that debt is already circulating and the Fed is creating new money to purchase that debt, it may be argued that the Fed purchase of the debt doubled the money created by the debt. However, it is the nature of the reserve barrier that the money the Fed created will remain in reserves until the debt is repaid. The payments come from circulating money and the repayment destroys the reserves.

Modern Money Theory (MMT) claims government spending creates money. See point #13 for more on this. The circulation of treasury securities within the economy just transfers reserves from bank to bank as the ownership of the securities change hands. This converts one owner’s securities money into money that can be spent into the productive economy but the transfer doesn’t create money

However, when the Fed purchases government securities, it creates new money in reserves and the seller acquires money that can be spent into the economy. There is a difference in repaying government securities held by the Fed than in repaying private debt held by the Fed.

As private debt owned by the Fed is repaid, the check clearing process removes money from the circulating money supply and the Fed destroys the principal part of the loan payment that is held in reserves. The interest portion of the debt repayment remains ensconced on the Fed side of the reserve barrier.

For public debt repayment (paying back treasury securities), the government extracts tax money. Tax money comes from the reserve account of the taxpayer’s bank and is moved into either TT&L accounts or to the TGA. If the security is privately owned, the clearing of the check the government writes transfers money from the TGA to reserves at the holder’s bank and the holder has money placed in his account that includes both principal and interest. Both the principal and interest become part of the economic money circulation.

If the security is held by the Fed, both the principal and interest are transferred from the TGA to the Fed and the debt is extinguished. To purchase that debt, the Fed had created money in the amount of the principal and put it in reserves. The payment to the Fed included both principal and interest. The debt has been extinguished so the principal part of the debt that the Fed had created is destroyed. The interest part of that payment remains ensconced on the Fed side of the reserve barrier. Interest earned by the Fed comes from money created by bank lending to the broader economy.

7. The payment of interest through borrowing is hidden.

The borrowing of interest is hidden because the person paying the interest is not the person borrowing the money. The person borrowing the money may be the employer of the person paying the interest. The borrowing is done elsewhere and the money circulates until it arrives through circuitous routes to the person paying the interest. It’s origins in debt are lost.

8. Because interest payments are borrowed, debt rises exponentially.

Debt rises exponentially. This is the consequence of #6. Even if all other factors that create exponential debt growth were removed, borrowing interest payments will cause exponential growth of debt.

Money Destruction

9. Paying back principal on a loan destroys that amount of money in the economy.

Money is created by writing a loan. When that loan is repaid, that amount of money is removed from the economy. Paying principal on a loan, even the amount in your monthly payments destroys that amount of money. Only if new loans are written is the money supply replenished.

When you take out a loan, your loan amount becomes an asset to the bank. The money the bank puts into your bank account becomes a liability–when you spend that money they have to provide it to the bank of the person you’ve written a check to.

When you make a payment, the principal part of your payment is entered in reverse. Your payment reduces their liability in the amount of the principal payment and reverses the amount of their assets by the principal amount. The difference (the interest) becomes a profit for the bank.

To best see the creation and destruction of these transactions, imagine you’ve taken out a loan. An hour later you get cold feet and pay off the loan. The entries in the balance sheet of the bank would be made to create the money and when you paid off the loan, the entries would be reversed and the newly created money would be destroyed.

The destruction of money from principal payments will reduce the amount of money circulating in the economy. The only way it will be replenished is if someone borrows enough to replenish it. If we all got religion and started paying off loans without borrowing to replace the retired loans, the total money supply would be decreased until the economy would be unable to function. This means that no amount of thrift or discipline can ever reduce overall debt.

10. Paying taxes transfers money from bank reserve accounts to the treasury.

Paying taxes transfers money from the reserve account of your bank to the TGA. Sometimes it takes a circuitous route through TT&L banks to get there, but eventually it does.

The taxes paid wither fund government spending or repay government debt. If spent, then it reduces the amount the government needs to borrow. If used to repay debt, see point #6 to see how that works.

If the government runs a surplus (collects more in taxes than it borrows), the number of treasury securities will decline. Since paying taxes removes money from the economy, the money supply is decreased. To keep up economic activity, this money must be replaced by additional borrowing. This is why MMT proponents claim that government deficit spending is a benefit to society. It reduces their need to increase their own debt; the government is in a much better position to borrow that money.

Federal Reserve Actions

11. The Fed interacts monetarily with banks through their reserve accounts.

Banks interact with the Federal Reserve through the banks’ reserve accounts. These accounts are (theoretically) set up to provide liquidity in case of a bank run. They have become much more.

12. US banks and money creation became unified under the Fed in 1913.

The creation of the Fed in 1913 solved many problems caused by unstable banks. Given the power the Fed was given over the creation of money, there were and are still problems. However, prior to the creation of the Fed, bank runs were common.

Bank stability was created by the Fed backing up its member banks with gold reserves. While the Fed didn’t directly own the gold, it was implied that the government would supply the gold if needed.

Gold backed money was abolished during the great depression; citizens were required to turn in their gold and the gold standard was reinstituted at a different price for gold. After World War II, the Bretton Woods agreement was implemented in which the US guaranteed to convert the dollar to gold and all other currencies would float relative to the dollar. In 1971 the gold standard was abolished worldwide when the US abrogated the Bretton Woods Agreement.

The money created without any commodity backing it up is called “fiat” money. While fiat money has a bad reputation, fiat money is one of humanity’s greatest inventions. We just need to learn how to use it. This website hopes to show how it can be used to better society.

13. Government spending creates new money in the form of treasury securities.

When the government borrows, it issues a treasury security that is auctioned to one of 24 dealers. Money from the reserve account at the winning bidder’s bank is transferred to the TGA. When the government spends, money from the TGA is transferred to the reserve account at a vendor’s bank. If the amounts borrowed and spent were equal, this would result in equal amounts of money being moved from a dealer’s account to a vendor’s account.

The amount of money in circulation would stay the same. The money in a dealer’s account is generally circulating involving financial transactions while a vendor’s account is generally circulating money in the productive economy. In this sense, this transfer of money to a more useful part of the economy has a net benefit to society.

But the treasury security created by this process allows the dealer to extract the money back out of the productive money circulation and return it to financial circulation. The amount returned to the dealer is greater than the amount removed because of interest. This means that the overall requirement that governments borrow to spend is a drain on the productive economy in favor of the financial economy.

The money created by the government spending is the treasury security. At the end of the borrowing and spending by the government, if the borrowing and spending is equal, the value of the total reserves remains the same, yet there is a treasury security that can circulate in financial transactions as another form of money. To see the process of repaying that debt, see point #6.

14. The Fed can convert treasury securities into cash.

This is the most complicated part of understanding money, so we’ll take it point by point:

-

- By law the treasury cannot overdraw its account at the Fed so the Treasury General Account (TGA) must be preloaded before it spends. That process is described below.

-

- The treasury writes treasury securities (bills, notes, or bonds) and presents those to the Fed. This adds to the federal (public) debt.

-

- The Fed, by law, cannot provide money to the treasury directly, so it sells the newly created securities to one or more of the 24 primary securities dealers through the Federal Open Market Committee (FOMC). In rare emergency cases, the Fed can provide the money directly. For example, after 9/11 the FOMC was shut down, so the Fed provided money directly.

-

- The money for the purchase of those securities is transferred from the dealer’s reserve account to the TGA. When the treasury authorizes payment to a vendor, the money from the TGA is transferred to the reserve account of the vendor’s bank and the bank credits the vendor’s bank account. These two actions keep bank reserves at the same level if the amount borrowed is the same as the amount spent, essentially transferring money from a dealer’s bank account to a vendor’s bank account (through several separate transactions).

-

- The Fed can trade in existing securities. The Fed controls interest rates by selling or purchasing treasury securities.

-

- When the Federal Reserve purchases a government security, it creates money out of thin air to put in the seller’s bank’s reserve account to make that purchase.

-

- When all the balance sheet entries are analyzed, government spending transfers cash from a security dealer’s bank’s reserve account to the reserve account of the vendor or person receiving the government spending. That cash then circulates through the economy.

-

- MMT proponents are right when they claim government spending creates new money but that money is in the form of a treasury security. When it is sold to the Fed, it creates cash that can circulate in the broader economy.

15. The Fed inefficiently controls economic growth by controlling interest rates.

Increasing interest rates slows the growth of the money supply; lowering interest rates increases the growth of the money supply. This is because bank lending, which creates the money, can fund more projects when interest rates are low than when they are high. High interest rates make more projects unaffordable.

-

- Since 2008, it has been increasingly difficult to control interest rates. The Fed has had to devise clever schemes to maintain control.

-

- When the Fed wants to inject money into the bank reserve accounts, it purchases a debt (primarily treasury securities) in the form of a “repo.” These are generally short term purchases of securities with the promise to repurchase them a short time later at a slightly higher price (i.e. paying interest on the money the seller extended.) The opposite trade is also done, a “reverse repo” in which the dealer offers to purchase a security and sell it back to the Fed for a slightly higher price. This removes money from the bank reserve accounts. These repo and reverse repo transactions control the interest rate by offering the volume of trades needed to achieve the desired interest rate.

-

- Quantitative easing is where the Fed trades in longer term securities (or even private debts) to influence long term interest rates. Long-term interest rates are generally higher than short-term interest rates. Markets get extremely skittish when long-term interest rates are lower than short-term interest rates.

-

- Controlling interest rates is an inefficient way to control the economy because adding money to the economy by controlling the amount in bank reserves is like pushing on a string. The bank customers must be induced to borrow or discouraged from borrowing and the bank must still approve or disapprove those loans.

Economic Issues

16. Economic growth can never keep pace with debt growth.

From 1947 to 2008, non-government debt rose 9.15% per annum while GDP grew by 6.5% over the same period. Even the ancients understood productivity could not grow as fast as debt so instituted debt jubilees. Debt jubilees aren’t an option in a modern economy because much debt is private, not only governmental. A country using fiat currencies has better alternatives than debt jubilees.

The average interest rate from 1947 to 2008 was 6%. That means that the money supply had to grow by at least 6% just to pay the interest on the money created. To keep inflation at a 2% rate (a common target of central banks), that means that productivity must grow by 4% annually. It is difficult to maintain a constant 4% growth in productivity. It requires large amounts of research and development that companies are reluctant to provide.

The constant war over inflation, debt, and GDP is the consequence of creating all money as debt. There are better methods.

17. Inequality is built into the system of debt created money.

Since there is no money except that created by debt, those lower on the economic ladder are overrepresented as borrowers. Since they are burdened with the interest payments, their economic growth is slower than those that can invest or purchase without borrowing (or can borrow larger amounts).

In a macroeconomic view, the movement of money is always toward the wealthy. Over time, the percentage of the population that are poor must grow. This is a mathematical result that can be modelled.

Most of us don’t see this in the US because there are still 60% of the population that is not living paycheck to paycheck. There are enough of them who consume enough to keep the economy functioning. Those who live paycheck to paycheck have no economic or political power so are ignored.

18. No amount of thrift or taxation will pay down total debt or create equality.

In a macroeconomic sense, paying back debt by any entity in the economy either removes money from the economy creating stagnation or must involve increasing debt by another entity. No amount of thrift will change this dynamic. The amount of new debt must include both the repaid principal plus interest.

Public debt can be reduced by increasing taxation. Increasing taxation slows down economic activity as economic money is moved from economic circulation into the bank accounts of those holding treasury securities. Since the wealthy don’t change their spending much depending on additional income, only a fraction of the money taken out of the economy circulates back in. To replenish the money removed, individuals and corporations need to borrow more.

Since the government has much greater borrowing capacity, it is easier to let public debt grow rather than shift that burden to the private sector.

Socialist policies will slow the rate of economic deterioration but will not cure the problem. The exponential growth curves have advanced too far to allow the socialist policies implemented in the 1930s from solving today’s problems.

19. Inequality creates inefficiencies in the economy.

Inequality creates massive inefficiencies in the economy. The pool of people unable to contribute significantly to economic activity will grow exponentially as the system increasingly transfers money to the wealthy.

Interest on debt will consume an ever-larger proportion of GDP because GDP grows slower than debt.

20. Currently 40% of the population barely contributes to economic spending.

40% of the population are living paycheck to paycheck. They have little in reserves. That means 40% of the population are barely contributing to economic activity. These people have less than $400 to pay an unexpected bill.

The median amount in people’s bank accounts for the whole country is $3500. There is a vast potential for economic growth that remains unrealized.

21. Workers are used as pawns to control the economy.

Using interest rates to control the economy is very inefficient and uses workers as pawns in this control. Raising interest rates discourages borrowers so economic activity slows as the growth in the money supply slows. Workers are laid off and the economy slows more.

When the Fed decides to lower interest rates, borrowers start to borrow again which puts more money into the economy. Workers are hired which puts even more money into the economy. Once the economy reaches full employment, additional economic growth creates inflation, so interest rates are raised again.

Economists call this the business cycle. It is more like idiocy. It is definitely exploitative.

22. Bankers control whether they will create cash by deciding to loan money.

The lower interest rates which are to inspire lending is still dependent on banks’ willingness to lend. The lower interest rates run counter to bank’s needs and the higher interest rates when trying to discourage lending also runs counter to bank desires.

Overall, using interest rates to control economic activity is foolish.

23. Taxing income or sales is an inefficient way of collecting taxes.

Since taxing income removes money before it is spent and sales taxes remove extra money as it is spent, collecting those taxes impact economic activity.

Because of the feedback loops, it is nearly impossible to judge exactly what the correct level of taxation should be. The uncertainty allows a great deal of latitude in setting tax rates. Changing rates is a long and slow legislative process. Add in the slow process of controlling the economy by changing interest rates, we see that moving the economy in one direction or the other is slow and cumbersome.

24. Taxing money transactions is a more efficient way to raise taxes.

There are $7.6 quadrillion in money transactions annually in the US. A tax of .1% of all transactions would raise $7.6 trillion for the government. A tax of double that would allow the government to fund a myriad of additional projects: rebuilding infrastructure, research and development, higher education, affordable housing, UBI, etc.

The tax rate could be annually adjusted so that money spent by the government in one year would be removed the following year allowing the money one year in circulation to do its work. It’s removal would prevent inflation as a result of government spending.

Inflation could still be present because this method of taxation would not eliminate inflation caused by excess bank creation of money. The tax rate could be further adjusted to control bank created inflation.

Since this tax could eliminate income, sales, and property taxes, any country that implemented such a tax plan would become a tax haven. Companies around the world would want to invest in such a country.

25. Savings and investments are not equal.

Economists who equate savings with investments don’t understand how money is created. Banks don’t need savings placed in bank accounts to use for loans—they create whatever money they need. Their only limitation is to maintain a robust balance sheet, so the loans must have a reasonable possibility of being repaid.

Most economists believe that what consumers don’t spend remains in bank accounts and banks use that to loan for investments. This is a legacy of gold standard economic thought. Even under the gold standard, this is not how money worked.

It is the health of the loans and the amount the bank keeps as assets that determines their ability to lend. The assumption that investment is all borrowed should be questioned as well. Much of investment comes out of bank profits.

26. Financial assets are considered wealth, but they are just paper used to create real wealth.

Financial assets should be used in the economy to create authentic wealth which are real (physical) assets or intellectual property. Durable goods generally consist of 15% of GDP. That means 85% of GDP production is consumed. However, interest is incurred on 100% of all money.

27. The stock market does not generally provide money to corporations.

The stock market does not generally provide money to corporations no matter how high their stock prices rise. Only IPOs, new stock issue (not stock splits), or sale of company owned stocks provide money to corporations.

Normal stock trading is a casino for wealthy people. The only reason it isn’t a zero sum game is because of inflation. If the inflation of the stock prices is greater than the house take, this casino has better returns than keeping the money in treasury securities.

28. The current system of creating money will fail.

The system of creating all money as debt will eventually fail. The symptoms of failure are already showing up. Patches will work temporarily but the nature of money creation must change. The solutions implemented in the 1930s won’t work again; we are too high up on the exponential curves.

Economic models can be created that remain stable for centuries. There are also historic examples of economic money systems that survived for centuries.

Conclusion

These bullet points identify a bleak future. It’s purpose is to emphasize the problems we are facing. The main thing the public needs to understand is that creating all money as debt is unsustainable.

When the failure of the system occurs, people need to realize there are options that can work for centuries. Until a catastrophe, our legislators won’t listen. However, when the system fails, there will be enough demand for solutions. Don’t accept any solution that continues to require government spending to involve borrowing. Therein lies debt slavery.

Bank created money can cause problems, but the primary problem is that governments around the world have given up their control of their money supply. If governmental money were created debt free, it could circulate throughout the economy and fund the operation of the economy without incurring debt.

If the government created money did not require repayment, money is no longer a limiting factor to enact government policies. The (insincere) lament of legislators of “where will the money come from” goes away.

Enough debt-free money would need to remain in circulation to operate the economy without relying on bank created money. Deficit spending by the government using debt-free money would begin to have an effect on bank lending. Once private borrowing stops exponential growth, the government can begin balancing its budget.

Unlimited government spending would cause massive inflation. This can be prevented by balancing the federal budget. This is where a change in the tax methods come in. Income taxes as a method of removing excess money from the economy allows too much cheating. A wealth tax would face similar hurdles. Where money moves offers an easy method for taxation and would be difficult to circumvent.

Slight changes to the tax rates on transactions would have an immediate effect on the economy. You wouldn’t have to wait for months or years for interest rate changes to implement change. The workers wouldn’t be pawns in regulating the economy.

The solutions proposed above may not be the only solutions. Any workable solution, however, must have at a minimum that government created money does not need to be repaid but any excess must be removed to prevent inflation.

These changes put control of the economy into the hands of politicians. Changes to tax rates, unlimited government spending, and power to create money are powerful incentives. When changes are made, some check to this power must be implemented at the same time.